PV is suitable for evaluating single cash flows or simple investments, while NPV is more appropriate for analyzing complex projects or investments with multiple cash flows occurring at different times. Present value is important because it allows investors and businesses to judge whether some future outcome will be worth making the investment today. It is also important in choosing among potential investments, especially if they are expected to pay off at different times in the future. A mentioned, the discount rate is the rate of return you use in the present value calculation. It represents your forgone rate of return if you chose to accept an amount in the future vs. the same amount today.

Risk and Present Value

The longer the time horizon, the lower the present value, as future cash flows are subject to a greater degree of discounting. Inflation affects the purchasing power of money over time, which in turn influences the present value of future cash flows. Higher inflation rates reduce the present value of future cash flows, while lower inflation rates increase present value. Higher interest rates result in lower present values, as future cash flows are discounted more heavily. Present Value is a financial concept that represents the current worth of a sum of money or a series of cash flows expected to be received in the future. Analysts use both of these financial metrics to assess if it is worth it to go forward with a project or investment opportunity.

The Present Value Formula

PV provides a snapshot of the value of a single future cash flow, while NPV offers a comprehensive assessment of the net value of an investment or project, considering all cash flows over time. While Present Value calculates the current value of a single future cash flow, Net Present Value (NPV) is used to evaluate the total value of a series of cash flows over time. To calculate the present value of a stream of future cash flows you would repeat the formula for each cash flow and then total them. Fortunately, you can easily do this using software or an online calculator rather than by hand. The value of the discounted cash flows (numerator) is exactly equal to what it costs to generate those cash flows (denominator). NPV is an essential tool for financial decision-making because it helps investors, business owners, and financial managers determine the profitability and viability of potential investments or projects.

Determining the Discount Rate

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- It also assumes that cash flows will be received at regular intervals, which may not always be the case.

The big difference between PV and NPV is that NPV takes into account the initial investment. The NPV formula for Excel uses the discount rate and a series of cash outflows and inflows. For example, if you are due to receive $1,000 five years from now—the future value (FV)—what is that worth to you today? Using the same 5% interest rate compounded annually, the answer is about $784.

Ask Any Financial Question

Also, for NPER, which is the number of periods, if you’re collecting an annuity payment monthly for four years, the NPER is 12 times 4, or 48. One key point to remember for PV formulas is that any money paid out (outflows) should be a negative number, while money in (inflows) is a positive number. In the present value formula shown above, we’re assuming that you know the future value and are solving for present value.

Essentially, it gives us the time frame for which the money is invested or borrowed. In this formula, FV stands for future value, r represents the interest rate per period, and n signifies the number of periods. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

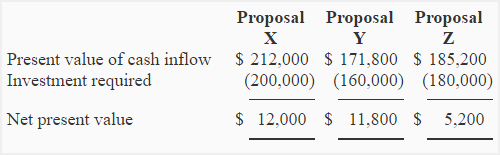

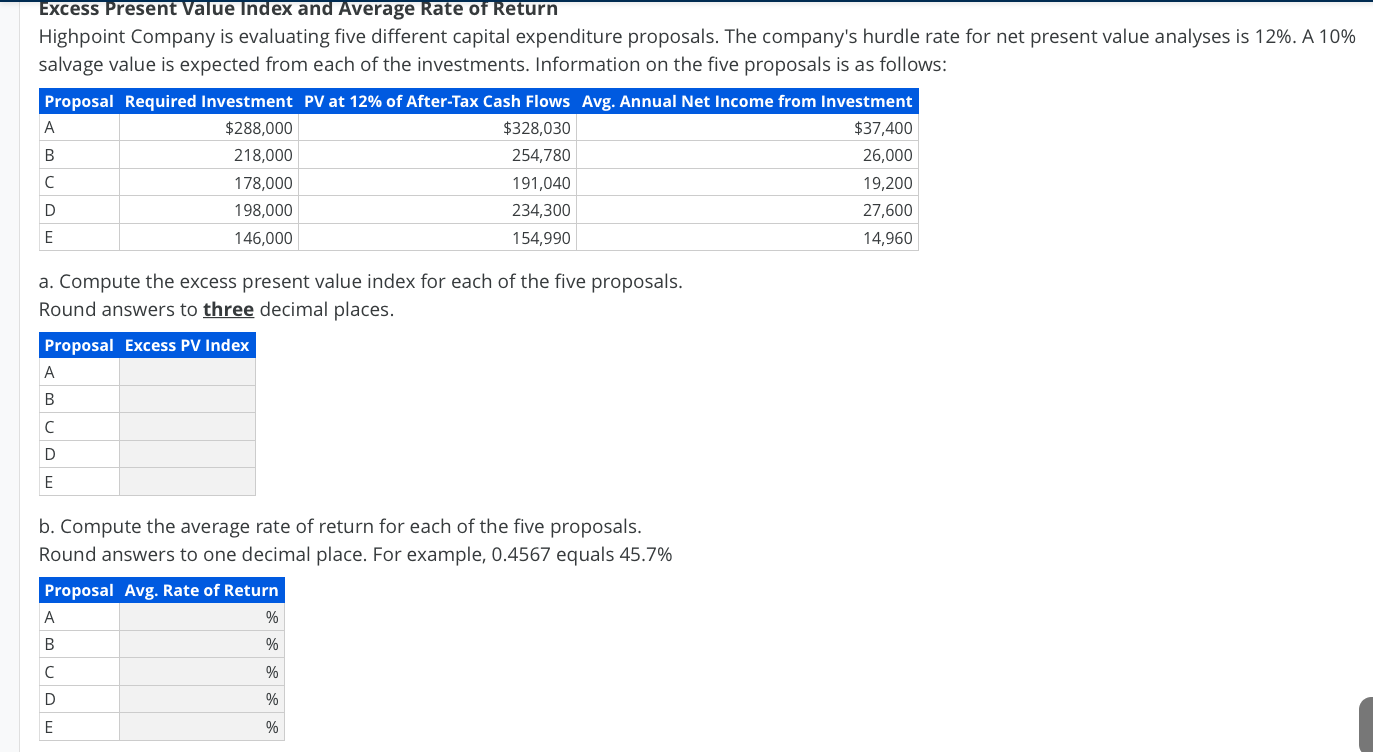

Conversely, a particular sum to be received in the future will not be worth as much as that same sum today. Also known as the benefit cost ratio, the present value index has to do with the relationship between the total expense involved with acquiring and owning an asset, and the net present value of that asset. The idea behind calculating the ratio is to determine if the investment is profitable or if the investor is currently experiencing a loss by continuing to hold that asset. The discount rate used in NPV calculations is a critical factor in determining the result. A higher discount rate will result in a lower NPV, while a lower discount rate will result in a higher NPV. This is because a higher discount rate reflects a higher opportunity cost of investing in the project, while a lower discount rate reflects a lower opportunity cost.

It is based on the concept of the time value of money, which states that a dollar today is worth more than it is tomorrow. Along with using the millions of americans might not get stimulus to evaluate the potential of a given investment, businesses can also use this same approach to evaluate the prospects of a particular project. As with securing assets, it is important to make sure all the data considered as part of the calculation is accurate and complete. Failure to do so could mean that the project ultimately costs more than projected or the results of the project do not provide the anticipated revenue stream. In either scenario, the project could ultimately incur a loss rather than generating profits for the company.