Accounting for redeemable preferred stock involves recognizing the redemption feature and its impact on the company’s financial statements. For non-redeemable preferred stock, the focus is on the ongoing dividend payments and their effect on equity. In the above example, the business issued 1,000 7% preferred equity stock at 100 par value. Since the company may issue shares at different times and at differing amounts, its credits to the capital stock account are not uniform amounts per share. This contrasts with issuing par value shares or shares with a stated value. In some states, the entire amount received for shares without par or stated value is the amount of legal capital.

Accounting Ratios

Corporations are able to offer a variety of features in their preferred stock, with the goal of making the stock more attractive to potential investors. All of the characteristics of each preferred stock issue are contained in a document called an indenture. Learn the essentials of accounting for preferred stock, including types, measurement, dividends, and financial statement impacts. The dividends not declared are said to be passed, and are referred to as dividends in arrears. As the passed dividends have not been declared they are not shown as a balance sheet liability but are referred to in a note to the financial statements. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

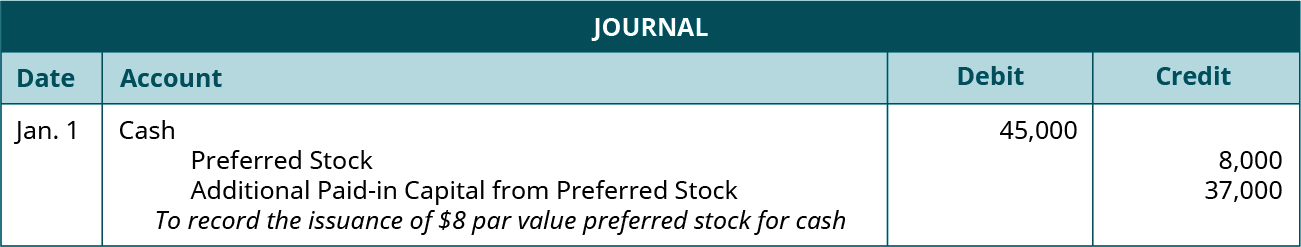

Issuance of preferred stock

These notes provide additional context, such as the terms of the preferred stock, dividend rates, and any embedded features like conversion or participation rights. This transparency helps investors and analysts make informed decisions by offering a comprehensive view of the company’s financial commitments and potential future obligations. Redeemable preferred stock can be how much can you contribute to a traditional ira for 2019 bought back by the issuing company at a predetermined price after a certain date. This feature provides companies with flexibility in managing their capital structure and can be an attractive option for investors seeking a defined exit strategy. Non-redeemable preferred stock, on the other hand, does not have this buyback feature, making it a more permanent form of equity.

Common And Preferred Stock

As you saw in the video, stock can be issued for cash or for other assets. When issuing capital stock for property or services, companies must determine the dollar amount of the exchange. Accountants generally record the transaction at the fair value of (1) the property or services received or (2) the stock issued, whichever is more clearly evident. In practice there is considerable diversity in the way preferred stock issues are structured. Some of the sub-classifications of the preferred stock include participatory preferred stock, cumulative preferred stock, non-cumulative preferred stock, callable preferred stock, convertible preferred stock, etc. Suppose a business is liquidated, if the preferred shares are non-participating, then they simply receive their original investment (in this case 105,000) and any preferred share dividends outstanding.

If the corporation receives more than the par amount, the amount greater than par will be recorded in another account such as Paid-in Capital in Excess of Par – Preferred Stock. For example, if one share of 9% preferred stock having a par value of $100 is sold for $101, the following entry will be made. Participating preferred shares gives stockholders the right to participate in additional dividends in addition to the preference dividend. The dividend on a preferred equity stock is usually fixed and based on the par value of the stock.

- Preferred stock that can be exchanged by the holder for a specified number of shares of common stock of the same company.

- However, as a practical matter, par values on common stock are set well below the issue price, negating any practical effect of this latent provision.

- When dividends are declared, the company must consider the potential impact on the conversion ratio.

Trial Balance

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Once declared, dividends become a legal obligation, and the company must record a liability on its balance sheet. This liability remains until the dividends are paid out to shareholders. The timing of this declaration and payment can significantly impact the company’s financial statements, particularly its cash flow and liquidity ratios.

Likewise, the $20,000 of common stock in the journal entry above comes from the 20,000 shares of common stock multiplying with $1 of the par value (20,000 shares x 1$). The dividend on preferred stock is usually stated as a percentage of its par value. For example, if a corporation issues 9% preferred stock with a par value of $100, the preferred stockholder will receive a dividend of $9 (9% times $100) per share per year. If the corporation issues 10% preferred stock having a par value of $25, the stock will pay a dividend of $2.50 (10% times $25) per year. In each of these examples the par value is meaningful because it is a factor in determining the dividend amounts.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.