Suppose Company A issues participating preferred shares with a dividend rate of $1 per share. The preferred shares also carry a clause on extra dividends for participating preferred stock, which is triggered whenever the dividend for common shares exceeds that of the preferred shares. Non-participating preferred stock only provides a dividend that is paid before common stockholders, but no share in remaining liquidation proceeds. Most preferred stock is non-participating, meaning, shareholders get paid the stated dividends, based on a fixed percentage of the offering price, and nothing more.

Preferred Dividend Calculator

Information about a company’s preferred shares is easier to obtain than information about the company’s bonds, making preferreds, in a general sense, perhaps more liquid and easier to trade. The low par values of the preferred shares also make investing easier, because bonds (with par values around $1,000) often have minimum purchase requirements. Fixed rates can also be disadvantageous when inflation is high because the dividend rates are not adjusted for inflation.

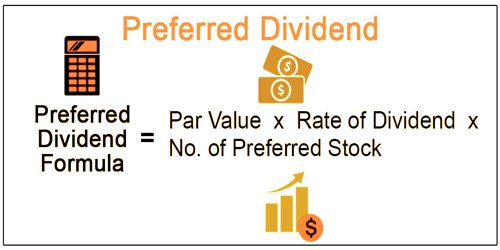

Create a Free Account and Ask Any Financial Question

Another similarity between preferred stocks and bonds is that while the market value of preferred shares can fluctuate, the dividends don’t. Preferred stocks have a set dividend rate that’s based on the “par value” of the stock — usually $25, but other amounts do exist. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend business tax credits definition amount to continue, quarter after quarter and year after year. Finally, multiply the number of missed dividend payments by the quarterly dividend amount to calculate the cumulative preferred dividends per share that you’re owed. Cumulative preferred dividends get paid after interest due to bondholders is paid. Bonds usually have higher priority than preferred shares in the capital structure.

Will there be any impact on diluted EPS for convertible preferred stocks if dividends were paid on them?

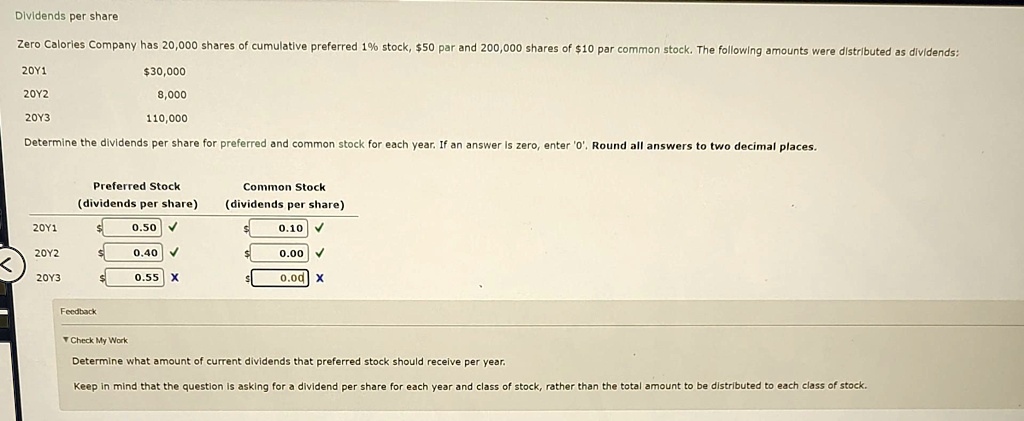

Because preferred shares are often compared with bonds and other debt instruments, let’s look at their similarities and differences. Company X Inc. has 3 million outstanding 5% preferred shares as of December 31st, 2016. Dividends on preferred stock are typically paid quarterly but can be paid more or less frequently at the discretion of the board of directors. Furthermore, the fact that the company is unable to pay a dividend may signal serious cash flow problems, which could have implications for creditors. For these reasons, the existence of dividends in arrears should be clearly disclosed. It’s crucial to understand that these payouts are not always assured and the companies may decide to distribute any accrued dividends before giving payments to shareholders.

Please Sign in to set this content as a favorite.

However, you should still consider it when evaluating the marketability of preferred shares. If it is necessary to assume conversion of preferred stock, an accountant must increase the denominator by the number of common shares that would have been issued. The general treatment of convertible preferred stock in earnings per share (EPS) calculations is basically identical to that used for convertible bonds. Whereas common stock is often called voting equity, preferred stocks usually have no voting rights. Preferreds technically have an unlimited life because they have no fixed maturity date, but they may be called by the issuer after a certain date.

- To determine the number of issue shares attributable to this, calculate earnings per share (eps) for the part of the year in which the convertible preferred stock was not outstanding.

- Preferred shares are a type of equity investment that provides a steady stream of income and potential appreciation.

- For example, assume the company plans to pay out $100,000 of retained earnings as dividends.

- The great advantage of investing in preferred stocks is that it is like a fixed instrument.

Cumulative versus Non-Cumulative Preferred Stock Payments

Like cumulative preferred stock, noncumulative shares require that the corporation pay all current preferred dividends before the corporation can distribute any dividends on common stock. However, owners of noncumulative preferred do not have any right to skipped dividends. Unless otherwise specified, you can assume that preferred shares are noncumulative. Participating preferred stock—like other forms of preferred stock—takes precedence in a firm’s capital structure over common stock but ranks below debt in liquidation events.

If a company has several simultaneous issues of preferred stock, then they might be ranked, and paid in order of preference. The highest ranked dividend is called prior, followed by first preference, second preference, and so on. Luckily, most of the time, preferred stock is given out pretty regularly, at the same price, so investors can expect dividends on a regular basis.

After a bankruptcy, preferred shareholders are ahead of common shareholders in line for payment, but they are behind bond holders, who must be paid first if there is money available. If a company does not have enough money left to pay its bond holders, it won’t be able to pay its preferred stockholders. And then, the firm will pay the accumulated preferred dividends to the preferred shareholders. This feature of arrear payment is only available with the cumulative preferred stock. And the firm is legally obligated to pay off the previous year’s preferred dividend before paying the current year’s dividend. Preferred Dividends are fixed dividends received from Preferred stocks.

It represents their share of the company’s profits and is an incentive for them to hold onto the stock for the long term. The board may raise, reduce, or eliminate its dividend based on the recent success of the business and depending on what other priorities it sees for the money. In this case, the second threshold was exceeded and the excess was shared on the basis of total par values (one-fourth to preferred stockholders, three-fourths to common stockholders). Let’s say you just bought 100 shares of a preferred stock and want to know how much your quarterly dividend distributions will be. Upon reading the prospectus, you discover that the stock’s par value is $25, and its dividend rate is 6.5%.