They can also be taxed at much higher rates than other dividends – sometimes as much as thirty-five percent. With that, different kinds of preferred dividends exist, with different tax consequences. True preferreds pay real dividends while trust preferreds pay interest income and are typically structured around corporate bonds. Sometimes, companies can issue both kinds of dividends, which only adds to the confusion.

Conversion or Issuance During the Period

Nonparticipating preferred shareholders would not receive additional consideration. If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock. If conversion is not assumed, the dividends on the preferred shares are deducted from net income to determine the earnings available to common stockholders.

How to Calculate Participating Dividend

Companies must pay down these accumulated dividend balances before resuming normal dividend payments. So cumulative dividends provide an extra level of security for preferred shareholders – they have seniority in receiving dividend payments. These are fixed dividends, normally for the life of the stock, but they must be declared by the company’s board of directors. As such, there is not the same array of guarantees that are afforded to bondholders.

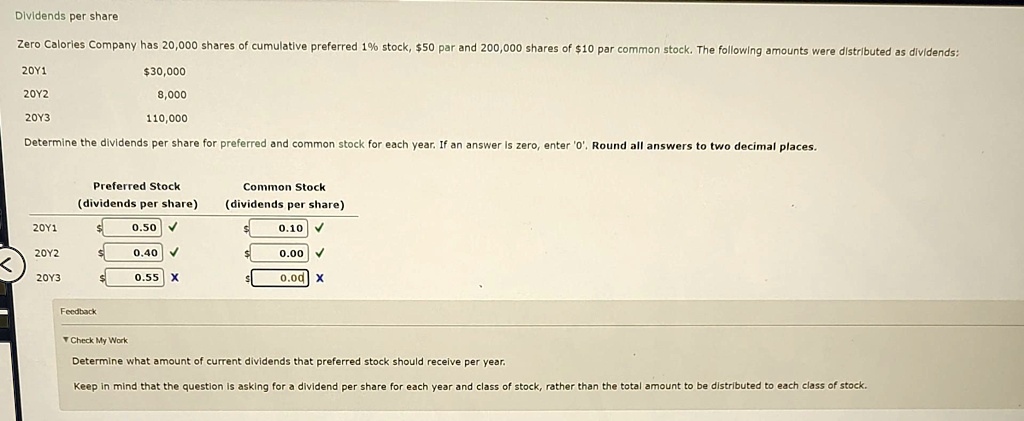

Preferred Dividend

Since 1992 Matt McGew has provided content for on and offline businesses and publications. Previous work has appeared in the “Los Angeles Times,” Travelocity and “GQ Magazine.” McGew specializes in search engine optimization and has a Master of Arts in journalism from New York University. If the dividend has a history of predictable growth, or the company states a constant growth will occur, you need to account for this. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

- In some cases, the fixed rate of dividend payments can be a disadvantage.

- Moreover companies carefully weigh the advantages and disadvantages of dividend policies when determining their steps.

- If the company does not declare and pay a dividend to preferred shareholders, it cannot pay a dividend to common shareholders.

- As such, there is not the same array of guarantees that are afforded to bondholders.

- For both reasons, these arrearages should be disclosed in the footnotes to the Financial Statements.

- A healthy company will have a high preferred dividend coverage ratio, indicating that it will have little difficulty in paying the preferred dividends it owes.

As a result, these payments are recorded as a current liability on the company’s balance sheet until they are disbursed. Preferred dividends hold significance as they represent consistent income payments to preferred shareholders, establishing an attractive incentive for investors. This predictability enhances a company’s ability to attract capital and maintain investor confidence. The timely payment of preferred dividends also showcases the company’s financial stability and commitment to fulfilling its obligations, contributing to a positive reputation in the market. In the above case, the company can’t pay a dividend to shareholders since the total available cash is less than the total amount of preferred dividend liability.

What is your current financial priority?

The higher the ratio, the less trouble the company will have in making its required dividend payments. A high ratio is good for common shareholders too because they can’t get paid until preferred shareholders get paid. Preferred dividends are allocated to and paid on a company’s preferred shares. If a company is unable to pay all dividends, claims to preferred dividends take precedence over claims to dividends that are paid on common shares.

This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. For example, say that a preferred stock had a par value of $100 per share and paid an 8% dividend. To calculate the dividend, you would need to multiply 8% by $100 (the par value), which comes out to an annual dividend of $8 per share. If dividend payments are made quarterly, each payment will be $2 per share. Yes, preferred dividends are typically classified as a current liability. This is because preferred dividend payments represent obligations to preferred shareholders that the company must fulfill in the near term, usually within a year.

In the case of non-cumulative preferred stocks, this feature of arrear payment is not available. Next, divide the annual dividend by four to calculate the preferred stock’s quarterly dividend payment. Participating preferred stock is rarely issued, but one way in which it is used is as a poison pill. In this case, current shareholders are issued stock that gives them the right to new common shares at a bargain price in the event of an unwanted takeover bid. For example, if ABC Company pays a 25-cent dividend every month and the required rate of return is 6% per year, then the expected value of the stock, using the dividend discount approach, would be $50. The discount rate was divided by 12 to get 0.005, but you could also use the yearly dividend of $3 (0.25 x 12) and divide it by the yearly discount rate of 0.06 to get $50.

Company XYZ issued 8% Cumulative Preferred shares with a Par value of $1,000 in 2016. In 2018 and 2019, the company didn’t earn any profit and made a loss. Calculate the cumulative dividend that the company will have to pay to the preferred shareholders. For example, suppose you own 1,000 shares of Company X cumulative preferred stock.

This says that, if any dividend payments have been skipped, they must be paid out to preferred shareholders before common shareholders are paid any current dividends. Cumulative dividend provisions are intended how to complete and file form w to give preferred shareholders confidence that they’ll receive the stated return on their investments. Non-cumulative preferred dividends, by contrast, only get paid if the company pays a dividend.

Company A has $10 million of preferred participating stock outstanding, representing 20% of the company’s capital structure with the other 80%, or $40 million, made up of common stock. The participating preferred shareholders would receive $10 million but also would be entitled to 20% of the remaining proceeds. That amount would be $10 million, calculated as 20% x ($60 million – $10 million).